KICKSTART YOUR INVESTMENT JOURNEY

By providing your email, you agree to our privacy policy. We respect your privacy and will never share your information without consent.

ELEVATE YOUR PORTFOLIO WITH A PROVEN LEADER…

You’ve witnessed Ryan’s exceptional track record at Sonoma Realty Group, where mastery in real estate brokerage merges with an intimate knowledge of market trends. Now, Terra Vue Capital opens its doors to you, extending an exclusive invitation to join an investment experience that has long benefited from Ryan’s unwavering commitment to excellence and deep industry insights.

Ryan’s journey has been marked by strategic foresight and a series of accolades that speak to his expertise: the coveted CCIM designation, a multi-state brokerage license, and a portfolio of thriving projects. At Terra Vue Capital, his seasoned eye for potential transforms into your investment advantage, turning market opportunities into legacies of wealth.

This is where your trust meets the next level of investment strategy. Embark on a journey with Ryan and Terra Vue Capital, aimed at not only fostering growth but also bringing a vision to fruition. Engage with us, and let the story of your financial triumph begin.

PASSIVE INCOME! IT'S AS EASY AS 1...2...3!

Browse our exclusive list of strategic real estate investments

Quickly verify your accredited investor status and explore our secure, user-friendly portal to select your investment

Finalize your investment easily with ACH transfer and watch your portfolio grow.

Unlock Your Passive Investing Potential

Join our newsletter and receive free eBook on 5 expert tips to streamline your real estate investments.

By providing your email, you agree to our privacy policy. We respect your privacy and will never share your information without consent.

TRACK RECORD & MANAGEMENT EXPERTISE

The Terra Vue Investments team brings together seasoned professionals with over 50 years of combined experience in the real estate sector. Our collective track record is a testament to our ability to identify, acquire, and manage real estate with precision and foresight. We pride ourselves on our past successes in delivering above-market returns and our continued commitment to upholding the highest standards of integrity and transparency in all our dealings.

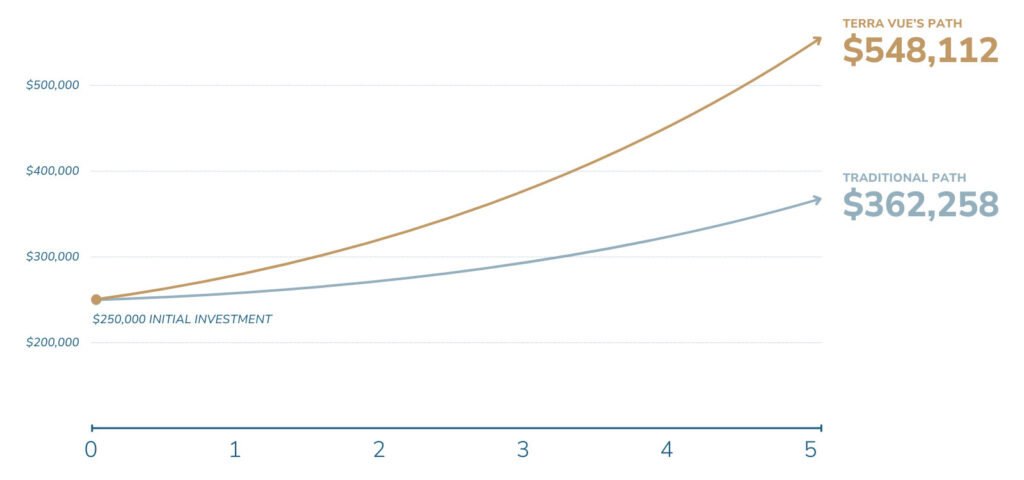

Accelerate Your Wealth: The 5-year Growth Difference

Potential Return Difference:

* Based on historical S&P 500 Performance over the last two decades.(Source: Yahoo Finance). The returns depicted above are hypothetical and represent an average outcome of multiple deals managed by Terra Vue. They are not predictive of results in any specific transaction. Individual deal outcomes may vary, and not all investments will perform similarly. This graphic is for illustrative purposes only and should not be considered as a guarantee of future performance.

Finding the right property in the right market.

Extensive independent financial analysis.

Crafting growth plans for construction or optimization of existing assets.

Negotiate favorable price and terms.

Guiding construction phases or enhancing property operations.

Strategizing profitable exits or refinancing for growth leverage.